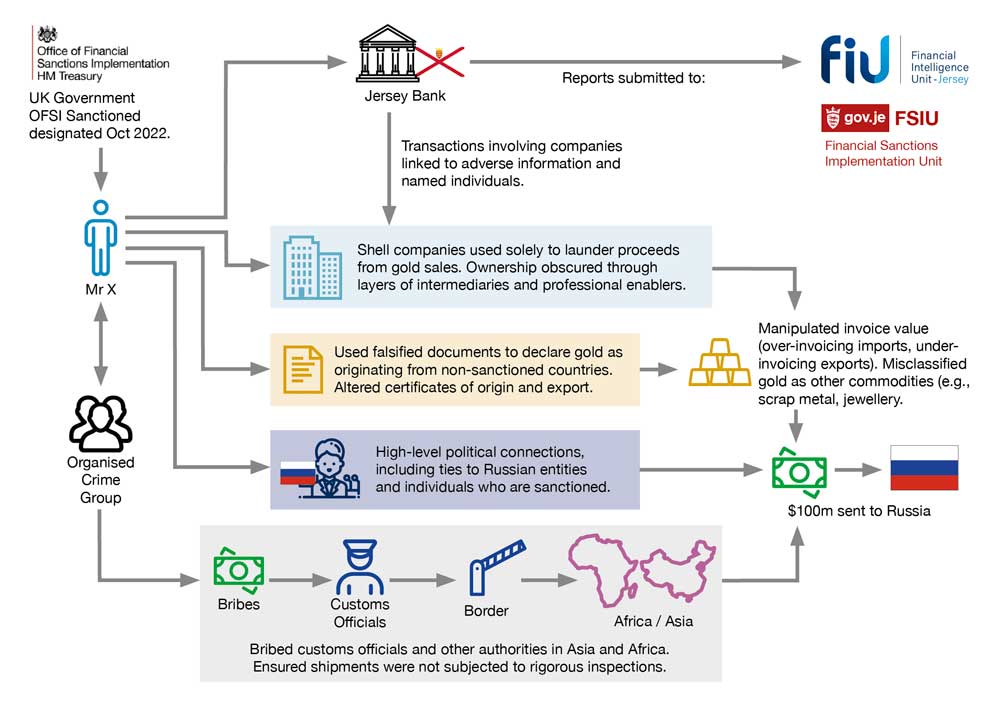

In 2023, the bank submitted a Suspicious Activity Report (SAR) to the FIU Jersey after uncovering serious allegations and adverse media against Mr. X. These revelations expose his alleged involvement in a web of illicit activities, including money laundering, evasion of international sanctions, organised crime, and tax evasion.

Mr. X, a South African national born in Zimbabwe, has been a client of a Jersey-regulated bank since 2015. He maintains joint accounts with his parents. He is the Managing Director of a trading company based in the Middle East.

It is alleged that Mr. X, through his association with an Organised Crime Group (OCG), orchestrated a sophisticated smuggling operation across multiple countries. The scheme involved transporting gold through a network of intermediaries and transit points to obscure its true origin.

Under Mr. X’s direction, the OCG utilised falsified documents to declare the gold as originating from non-sanctioned countries. This process included altering certificates of origin and export licenses. To further evade detection, Mr. X established numerous shell companies in various jurisdictions, including Europe, the Caribbean, and the Far East. These entities had no legitimate business operations and were solely used to launder the proceeds from gold sales. The ownership of these shell companies was deliberately concealed through layers of intermediaries, making it challenging for authorities to trace the ultimate beneficiaries.

The OCG also bribed customs officials and other authorities in Asia and Africa to ensure the smooth passage of smuggled gold, avoiding rigorous inspections. The network engaged in trade-based money laundering by manipulating invoice values, over-invoicing imports, and under-invoicing exports to move value across borders without attracting suspicion. Additionally, gold was often misclassified as other commodities, such as scrap metal or jewellery components, to avoid detection.

Mr. X leveraged high-level political connections that played a crucial role in the operation. These connections may have included ties to Russian entities and individuals under sanctions for their roles in destabilising Ukraine. Allegedly, over $100 million in proceeds from the smuggled gold were funnelled into Russia, supporting various sanctioned entities and individuals.

A review of Mr. X’s joint account revealed that it was primarily used for general payments to and from family members and for investments.

However, the review also identified transactions involving two companies allegedly connected to the adverse information, along with several credits from an associated individual. The remitting bank was situated in a high-risk jurisdiction.

Both companies had minimal available information and lacked any online presence. One company maintained a generic website that referenced services related to company creation. The bank review found no supporting documentation or rationale for the credits and debits from these companies.

In November 2023, the bank sent a Continuation Report to the FIU Jersey with the following update:

Due to his alleged involvement in these illicit activities, Mr. X has been added to the UK sanctions list3. This inclusion aims to restrict his ability to operate within the UK and access financial systems, thereby curbing his network’s activities.

This case study highlights the intricate methods Mr. X and his network used to smuggle gold and evade sanctions. It underscores the importance of international cooperation and robust regulatory frameworks to combat such activities. Enhanced due diligence and stringent enforcement of anti-money laundering regulations are crucial in addressing these challenges.

1 https://www.gov.uk/government/publications/the-uk-sanctions-list

2 https://www.gov.je/government/departments/jerseyworld/pages/sanctionsfaq.aspx

3 https://www.gov.uk/government/publications/the-uk-sanctions-list

5 https://www.gov.uk/government/organisations/office-of-financial-sanctions-implementation

ML is the process of making illegally obtained funds appear legitimate. This typically involves three key stages:

ML is a serious crime that undermines the financial system, facilitates further criminal activity, and poses significant challenges for law enforcement agencies. It is a global issue that requires coordinated efforts from governments and organisations worldwide to combat effectively.

Bribery is the act of offering, giving, receiving, or soliciting something of value as a means to influence the actions of an individual in a position of authority. This can involve cash payments, gifts, services, or other forms of compensation. It typically occurs in situations where the recipient is expected to provide a benefit in return, such as favorable treatment, contracts, or legal judgments.

Bribery is prevalent in many spheres, including politics, business, and various levels of government. It distorts free markets and can lead to situations where decisions are made based on personal gain rather than merit or public interest. The consequences of bribery can be profound, leading to unfair advantages, damaged reputations, and legal ramifications for both the giver and receiver.

Corruption encompasses a broader range of unethical behaviors that abuse positions of power for personal gain. While bribery is one form of corruption, it also includes practices such as nepotism (favoring relatives or friends by giving them jobs), cronyism (favoring friends or associates in political or business decisions), fraud, embezzlement, and the manipulation of regulations to benefit oneself at the expense of the greater good.

Corruption can occur in both the public and private sectors and often leads to severe societal consequences, including the erosion of trust in institutions, increased inequality, and stagnated economic growth. When officials engage in corrupt behavior, it can hinder the effectiveness of government functions, resulting in poorer quality public services and infrastructure. Additionally, corruption can deter foreign investment, increase risks in business operations, and perpetuate cycles of poverty and disenfranchisement in communities.

Both bribery and corruption are detrimental to society and necessitate robust legal frameworks and ethical standards to combat their prevalence and restore integrity in institutions.

OCGs are structured criminal organisations that engage in illegal activities for profit. These groups often operate hierarchically, with defined roles and responsibilities among members. OCGs may be involved in a variety of illicit enterprises, including drug trafficking, human trafficking, arms smuggling, extortion, money laundering, and racketeering.

Typically characterised by their secrecy and sophistication, OCGs utilise corruption, violence, and intimidation to maintain their operations and protect their interests. They often have connections to legitimate businesses, which they may use to launder money or further their criminal activities. The influence of OCGs can extend across borders, making them significant players in international crime networks.

The presence of OCGs poses serious challenges to law enforcement agencies, as their operations are often well-coordinated and strategically planned. Efforts to dismantle these organisations require cooperation between national and international authorities, as well as community involvement to address the social issues that allow organised crime to flourish.

Sanctions evasion refers to the act of circumventing or violating economic sanctions imposed by governments or international bodies. These sanctions are typically put in place to restrict trade, financial transactions, or other interactions with specific countries, entities, or individuals due to political, military, or human rights concerns. Evasion can take various forms, such as using third-party countries to conduct transactions, falsifying documents, or employing complex financial networks to disguise the origin or destination of goods and services. Companies or individuals engaging in sanctions evasion risk legal penalties, including heavy fines and criminal charges, and contribute to undermining the effectiveness of international sanctions designed to promote global stability and uphold human rights.

We continually strive to enhance the quality of the products we produce, from our typologies to reports, Insight papers to training guides. However, we can only improve if you share your feedback with us about what you think about them. This is your chance to let us know and we appreciate it your feedback. Click the navy button below or scan the QR code.

Tell us what you think >.svg)